What is ve(3,3)?

Why ve(3,3) is the future of DeFi

Why there is a need for another AMM model?

Uniswap's concentrated liquidity model offers capital efficiency but struggles with position rebalancing across top pools. Curve's stable swap mechanism excels with similar assets but underperforms with volatile pairs. Solidly attempted to address these issues but failed to properly align incentives across stakeholders.

Many protocols boast impressive TVL figures, yet much of this liquidity remains underutilized—as evidenced by the example below showing nearly 70% of the TVL generating minimal fees. Meanwhile, token holders often receive zero protocol revenue despite bearing dilution costs.

Understanding the need with an example:

According to the data, Uniswap generated $5.14 million in fees over a seven-day period in March, with the top 15 pairs accounting for $3.21 million, or 62.45%. These top pairs account for only $737.66 million, or 18.7% of total TVL, implying that the remaining $3.947 billion (or 81.3%) is largely underutilised.

So, how to incentivize liquidity providers to rebalance their positions to the most active pools? The answer lies in the concept of ve(3,3), a novel model that aims to address this issue by providing a more efficient and transparent way to allocate capital to the most active pools, resulting in higher liquidity utilization and reduced slippage.

What is the ve(3,3) Model?

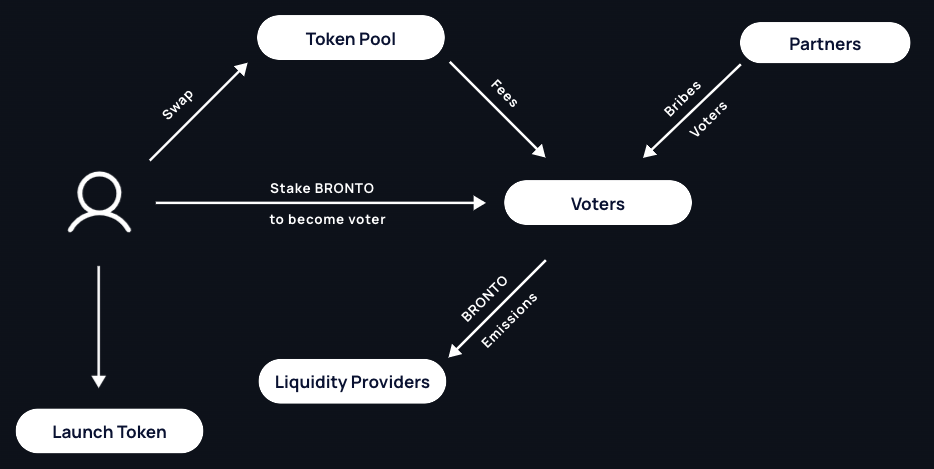

The ve(3,3) model in Bronto represents a groundbreaking fusion of two powerful DeFi tokenomic designs: the vote-escrow (ve) model pioneered by Curve Finance and the (3,3) game theory model introduced by Olympus DAO. This hybrid approach creates a unique ecosystem that aligns incentives across all stakeholders and addresses liquidity efficiency issues present in traditional DEX models.

Understanding the Components

Vote-Escrow (ve) Model

The "ve" component adopts the time-weighted voting mechanism where:

- Users lock their BRONTO tokens for a specified period (up to 4 years)

- Longer lock periods grant proportionally higher voting power

- This voting power allows users to:

- Direct protocol incentives toward specific liquidity pools

- Participate in governance decisions

- Earn a share of trading fees from the platform

The (3,3) Game Theory Model

The (3,3) component introduces mechanisms that discourage short-term speculation and promote long-term alignment:

- The model incentivizes users to stake and lock their tokens rather than sell them

- When users lock their tokens, they create positive pressure on the ecosystem (3)

- When others also lock their tokens, everyone benefits from a more stable protocol (3,3)

How ve(3,3) Addresses Traditional DEX Problems

| Problem | Traditional DEXs | Bronto |

|---|---|---|

| Inefficient TVL | Large portions of TVL generate minimal fees | Targeted incentives direct liquidity to high-performing pools |

| Misaligned Incentives | Token holders often receive 0% of fees | Fee sharing directly with veTokens holders |

| Dilution | Continuous emissions dilute token value | Weeky rebases mitigate dilution |

Emissions and Rebases

Every week, also refered to as an Epoch, BRONTO stakers decide which liquidity pools to allocate emissions to. Emissions are then routed to the selected liquidity pools in accordance with that vote, which ends every Thursday at 0:00 UTC. To see the emission schedule, visit Emissions.

Unlike traditional tokenomic models where emissions continuously dilute token holders, rebasing ensures that veBRONTO holders automatically maintain their relative ownership percentage within the protocol.

When new BRONTO tokens are emitted, the locked positions of veBRONTO holders are automatically rebased, effectively shielding them from dilution. This means users who commit to the protocol by locking their tokens don't need to constantly buy and lock additional tokens to maintain their governance power and fee-earning capability.

To learn more about rebases, visit Dilution Protection (Rebase).

Maximize capital efficiency, align incentives, and optimize fee distribution with the ve(3,3) model.